Passage 2

The data a bank has stored on its servers is more valuable than the gold in its vaults.Banks enjoy a monopoly over data that has helped them get away with poor services and fend off competitors.In Europe,at least,that is all about to change with a new set of regulations,named PSD2.

The rules will compel banks to share data easily with licensed third parties.Bankers in Europe complain that their profits and customer relationships are under threat.However,opening up banks,and the data they store,is good for consumers and competition.New providers will be better placed to offer all sorts of innovative services,such as a one-click option to put unspent monthly income into a pension plan.

Nevertheless.some concerns about PSD2 are legitimate.In particular,it is reasonable to wonder about the privacy and security implications of sensitive financial data being shared with third parties.But banks themselves are hardly invulnerable to cyber attack(网络攻击).And the solutions that the European regulators propose to deal with these worries look promising.Third parties that want to use bank data will need to convince national regulators that their data defenses are solid and are subject to annual regulatory inspections.

The gap between writing rules and implementing them is always large.First,consent from customers to provide access to their bank data must be gained explicitly,and the purposes of the data use should be clearly explained.Second,regulators must be very tough both in ensuring that banks open up their infrastructure and in withdrawing the licenses of third parties that break the rules.Third,regulators must also be flexible enough to allow for changes as the market evolves.Since the new entrants will not be licensed to engage in riskier financial activities—such as lending money—it makes sense to regulate them with a lighter touch.But if some Fintech providers do end up becoming systemically important,higher standards of oversight might be necessary

What can be inferred from passage on the effects of PSD2 in the second paragraph ( )

题干问:根据第二段,PSD2规定产生的影响是什么。根据第二段However,opening up banks,and the data they store,is good for consumers and competition.New providers will be better placed to offer all sorts of innovative services,such as a one-click option to put unspent monthly income into a pension plan.可知New providers将提供各式各样的创新性的服务(给客户),故A正确;而本题干扰项是D项,但是D项错在“receive more pension”,原文只是说:通过点击一下,(客户)就可把未花出去的月收入放进退休金中。而不是收到更多的退休金,这个退休金本来就是自己的钱。故排除D。A项:客户更有可能享受更多的创新性服务;B项:人们将不再去银行存钱,原文未提及;C项:服务提供者并不想和银行合作,原文未提及。D项:人们将收到更多退休金。故本题正确答案选A。

根据《中华人民共和国中国人民银行法》的规定,我国货币政策的最终目标是( ),并以此促进经济增长。

箱子里面有红、白两种玻璃球,红球数比白球数的3倍多两个,每次从箱子里取出7个白球、15个红球。如果经过若干次以后,箱子里只剩下3个白球、53个红球,那么,箱子里原有红球比白球多多少个?

将自然数1~100分别写在完全相同的100张卡片上,然后打乱卡片,先后随机取出4张,问这4张先后取出的卡片上的数字呈增序的几率是多少?()

对于债券利率的风险结构,描述正确的有( )。

市场经济体制下,财政具有的职能有( )。

( )决定着生产关系。

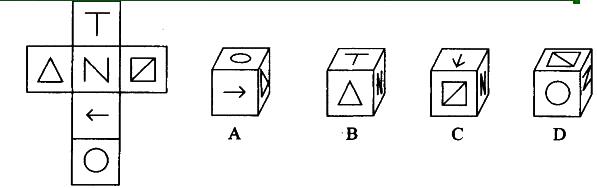

左边给定的是纸盒的外表面,下列哪一项能由它折叠而成?( )

货币制度最基本的内容是规定( )。

如果一国货币汇率上升,即对外升值,就可能会导致( )。

()