Passage 2

The data a bank has stored on its servers is more valuable than the gold in its vaults.Banks enjoy a monopoly over data that has helped them get away with poor services and fend off competitors.In Europe,at least,that is all about to change with a new set of regulations,named PSD2.

The rules will compel banks to share data easily with licensed third parties.Bankers in Europe complain that their profits and customer relationships are under threat.However,opening up banks,and the data they store,is good for consumers and competition.New providers will be better placed to offer all sorts of innovative services,such as a one-click option to put unspent monthly income into a pension plan.

Nevertheless.some concerns about PSD2 are legitimate.In particular,it is reasonable to wonder about the privacy and security implications of sensitive financial data being shared with third parties.But banks themselves are hardly invulnerable to cyber attack(网络攻击).And the solutions that the European regulators propose to deal with these worries look promising.Third parties that want to use bank data will need to convince national regulators that their data defenses are solid and are subject to annual regulatory inspections.

The gap between writing rules and implementing them is always large.First,consent from customers to provide access to their bank data must be gained explicitly,and the purposes of the data use should be clearly explained.Second,regulators must be very tough both in ensuring that banks open up their infrastructure and in withdrawing the licenses of third parties that break the rules.Third,regulators must also be flexible enough to allow for changes as the market evolves.Since the new entrants will not be licensed to engage in riskier financial activities—such as lending money—it makes sense to regulate them with a lighter touch.But if some Fintech providers do end up becoming systemically important,higher standards of oversight might be necessary

Which of the following is true in order to successfully implement PSD2 ( ).

根据题干关键词“to successfully implement PSD2”,定位到最后一段“The gap between writing rules and implementing them is always large.····”。从First,consent from customers to provide access to their bank data must be gained explicitly,and the purposes of the data use should be clearly explained.可看出,要实施PSD2,必须征得客户的明确同意,并且说明使用数据的目的。A项的“are forced to”用词不当,语气上,该规定并未强迫客户···,而是要去征求客户的同意,故排除;B项错在“their entire operational system”原文未提及,且语义过于绝对。排除;从Second,regulators must be very tough both in ensuring···.Third,regulators must also be flexible enough to···.可看出,监管者既要严格,又要有一定的灵活度,故C项正确。从Since the new entrants will not be licensed to engage in riskier financial activities—such as lending money—it makes sense to regulate them with a lighter touch.But if some Fintech providers do end up becoming systemically important,higher standards of oversight might be necessary可知,以及结合原文第二段The rules will compel banks to share data easily with licensed third parties可知,该句中的“new entrants”是指“third parties”,而D项错在“Banks and third parties”。且原文是“with a lighter touch”,而D项是“with a light touch”,也有细微的区别。故排除D。故本题正确答案选C。

根据《中华人民共和国中国人民银行法》的规定,我国货币政策的最终目标是( ),并以此促进经济增长。

箱子里面有红、白两种玻璃球,红球数比白球数的3倍多两个,每次从箱子里取出7个白球、15个红球。如果经过若干次以后,箱子里只剩下3个白球、53个红球,那么,箱子里原有红球比白球多多少个?

将自然数1~100分别写在完全相同的100张卡片上,然后打乱卡片,先后随机取出4张,问这4张先后取出的卡片上的数字呈增序的几率是多少?()

对于债券利率的风险结构,描述正确的有( )。

市场经济体制下,财政具有的职能有( )。

( )决定着生产关系。

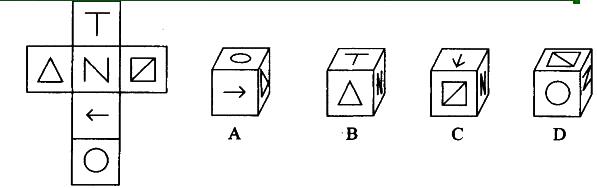

左边给定的是纸盒的外表面,下列哪一项能由它折叠而成?( )

货币制度最基本的内容是规定( )。

如果一国货币汇率上升,即对外升值,就可能会导致( )。

()