Passage 3

Imagine waking up and finding the value of your assets has been halved.No,you’re not an investor in one of those hedge funds that failed completely.With the dollar slumping to a 26-year low against the pound,already-expensive London has become quite unaffordable.A coffee at Starbucks,just as unavoidable in England as it is in the United States,runs about$8.

The once all-powerful dollar isn’t doing a Titanic against just the pound.It is sitting at a record low against the euro and at a 30-year low against the Canadian dollar.Even the Argentine peso and Brazilian real are thriving against the dollar.

The weak dollar is a source of humiliation,for a nation’s self-esteem rests in part on the strength of its currency.It’s also a potential economic problem,since a declining dollar makes imported food more expensive and exerts upward pressure on interest rates.And yet there are substantial sectors of the vast U.S.economy-from giant companies like Coca-Cola to mom-and-pop restaurant operators in Miami—for which the weak dollar is most excellent news.

Many Europeans may view the U.S,as an arrogant superpower that has become hostile to foreigners.But nothing makes people think more warmly of the U.S.than a weak dollar.Through April,the total number of visitors from abroad was up 6.8 percent from last year.Should the trend continue,the number of tourists this year will finally top the 2000 peak.Many Europeans now apparently view the U.S.the way many Americans view Mexico―as a cheap place to vacation,shop and party,all while ignoring the fact that the poorer locals can’t afford to join the merrymaking.

The money tourists spend helps decrease our chronic trade deficit.So do exports,which,thanks in part to the weak dollar,soared 11 percent between May 2006 and May 2007.For first five months of 2007,the trade deficit actually fell 7 percent from 2006.

If you own shares in large American corporations,you’re a winner in the weak-dollar gamble.Last week Coca-Cola’s stock bubbled to a five-year high after it reported a fantastic quarter.Foreign sales accounted for 65 percent of Coke’s beverage(饮料)business.Other American companies profiting from this trend include McDonald’s and IBM.

American tourists,however,shouldn’t expect any relief soon.The dollar lost strength the way many marriages break up-slowly,and then all at once.And currencies don’t turn on a dime.So if you want to avoid the pain inflicted by the increasingly pathetic dollar,cancel that summer vacation to England and look to New England.There,the dollar is still treated with a little respect.

In the author’s opinion,the weak dollar leads to the following consequences EXCEPT that( ).

根据文章内容,可知美元贬值所产生的影响:欧洲人对美国产生更多的好感,进口商品对美国人来说更加昂贵,并且也会使得美国大公司赚取更多的利润。因此本国货币贬值只会在本国受到尊重,A项错误。故本题正确答案选A。

根据《中华人民共和国中国人民银行法》的规定,我国货币政策的最终目标是( ),并以此促进经济增长。

箱子里面有红、白两种玻璃球,红球数比白球数的3倍多两个,每次从箱子里取出7个白球、15个红球。如果经过若干次以后,箱子里只剩下3个白球、53个红球,那么,箱子里原有红球比白球多多少个?

将自然数1~100分别写在完全相同的100张卡片上,然后打乱卡片,先后随机取出4张,问这4张先后取出的卡片上的数字呈增序的几率是多少?()

对于债券利率的风险结构,描述正确的有( )。

市场经济体制下,财政具有的职能有( )。

( )决定着生产关系。

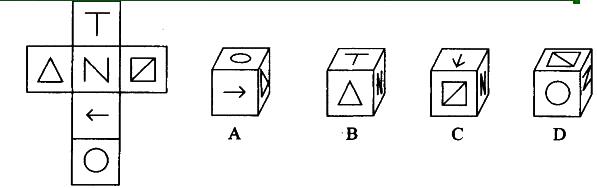

左边给定的是纸盒的外表面,下列哪一项能由它折叠而成?( )

货币制度最基本的内容是规定( )。

如果一国货币汇率上升,即对外升值,就可能会导致( )。

()