Passage 4

Insurance is the sharing of risks.Nearly everyone is exposed to risk of some sort.The house-owner,for example,knows that his property can be damaged by fire;the ship-owner knows that his vessel may be lost at sea;the breadwinner knows that he may die at an early age and leave his family the poorer.On the other hand,not every house is damaged by fire nor every vessel lost at sea.If these persons each put a small sum into a pool,there will be enough to meet the needs of the few who do suffer loss.In other words,the losses of the few are met from the contributions of the many.This is the basis of insurance.Those who pay the contribution are known as"insured"and those who administer the pool of contributions as"insurers".

Not all risks lend themselves to being covered by insurance.Broadly speaking,the ordinary risks of business and speculation cannot be covered.The risk that buyers will not buy goods at the prices offered is not of a kind that can be statistically estimated—and risks can only be insured against if they can be so estimated.

The legal basis of all insurance is the"policy".This is the printed form of contract on paper of the best quality.It states that in return for the regular payment by the insured of a named sum of money,called the"premium",which is usually paid every year,the insurer will pay a sum of money or compensation for loss,if the risk or event insured against actually happens.The wording of policies,particularly in marine insurance,often seems very old-fashioned,but there is a sound reason for this.Over a large number of years many law cases have been brought to clear up the meaning of doubtful phrases in policies.The law courts,in their judgments,have given these phrases a definite and indisputable meaning,and to avoid future disputes the phrases have continued to be used in policies even when they have passed out of normal use in speech.

The phrase"the pool of contributions"in the first paragraph means( ).

定位至首段最后the losses of the few are met from the contributions of the many...Those who pay the contribution are known as"insured"and those who administer the pool of contributions as"insurers"可知指的是通过被保人集中起来的金钱,选项C表述正确。选项A本身表达有误,是insured,而不是insurers;选项B首段并未提到;选项D的主体词在文章末尾才提到。故本题正确答案选C。

根据《中华人民共和国中国人民银行法》的规定,我国货币政策的最终目标是( ),并以此促进经济增长。

箱子里面有红、白两种玻璃球,红球数比白球数的3倍多两个,每次从箱子里取出7个白球、15个红球。如果经过若干次以后,箱子里只剩下3个白球、53个红球,那么,箱子里原有红球比白球多多少个?

将自然数1~100分别写在完全相同的100张卡片上,然后打乱卡片,先后随机取出4张,问这4张先后取出的卡片上的数字呈增序的几率是多少?()

对于债券利率的风险结构,描述正确的有( )。

市场经济体制下,财政具有的职能有( )。

( )决定着生产关系。

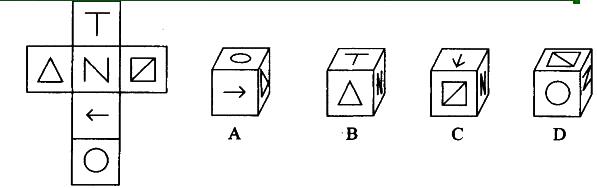

左边给定的是纸盒的外表面,下列哪一项能由它折叠而成?( )

货币制度最基本的内容是规定( )。

如果一国货币汇率上升,即对外升值,就可能会导致( )。

()