Passage 8

The very loans that are supposed to help seniors stay in their homes are in many cases pushing them out.Reverse mortgages,which allow homeowners 62 and older to borrow money against the value of their homes and not pay it back until they move out or die,have long been fraught with problems.But federal and state regulators are documenting new instances of abuse as smaller mortgage brokers,including former subprime lenders,flood the market after the recent exit of big banks and as defaults on the loans hit record rates.

Some lenders are aggressively pitching loans to seniors who cannot afford the fees associated with them,not to mention the property taxes and maintenance.Others are wooing seniors with promises that the loans are free money that can be used to finance long-coveted cruises,without clearly explaining the risks.Some widows are facing eviction after they say they were pressured to keep their name off the deed without being told that they could be left facing foreclosure after their husbands died.

Now,as the vast baby boomer generation is entering retirement and more seniors struggle with declining savings,the newly minted Consumer Financial Protection Bureau is working on new rules that could mean better disclosure for consumers and stricter supervision of lenders.More than 775,000 of such loans are outstanding,according to the federal government.

Concerns about the multibillion-dollar reverse mortgage market echo those raised in the lead-up to the financial crisis when consumers were marketed loans—often carrying hidden risks—that they could not afford.“There are many of the same red flags,including explosive growth and the fact that these loans are often advertised aggressively without regard to suitability,”said Lori Swanson,the Minnesota attorney general,who is working on reforming the reverse mortgage market.

Which is true about the new rules from Consumer Financial Protection Bureau

根据题干关键词Consumer Financial Protection Bureau定位至第四段…new rules that could mean better disclosure for consumers and stricter supervision of lenders.可知新政策对消费者意味着更多知情权,对放款人管理更严格,因此只有C项符合题意。选项AD明显表述错误,选项B在文中也未提及。故本题正确答案选C。

根据《中华人民共和国中国人民银行法》的规定,我国货币政策的最终目标是( ),并以此促进经济增长。

箱子里面有红、白两种玻璃球,红球数比白球数的3倍多两个,每次从箱子里取出7个白球、15个红球。如果经过若干次以后,箱子里只剩下3个白球、53个红球,那么,箱子里原有红球比白球多多少个?

将自然数1~100分别写在完全相同的100张卡片上,然后打乱卡片,先后随机取出4张,问这4张先后取出的卡片上的数字呈增序的几率是多少?()

对于债券利率的风险结构,描述正确的有( )。

市场经济体制下,财政具有的职能有( )。

( )决定着生产关系。

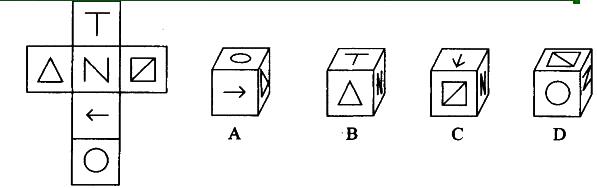

左边给定的是纸盒的外表面,下列哪一项能由它折叠而成?( )

货币制度最基本的内容是规定( )。

如果一国货币汇率上升,即对外升值,就可能会导致( )。

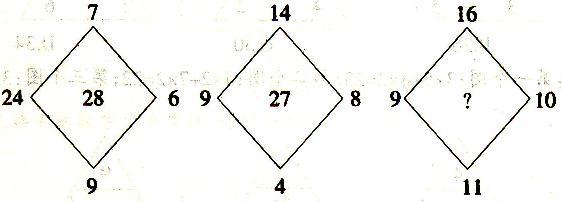

()