A firm’s cash flows can be divided into cash flow from operating activities,investment activities,and financing activities. The operation activity cash flows are cash flows—inflows and outflows—directly related to origination and sale of the financial firm’s assets and to operating costs such as general market activities,security trading activities,interest received and foreclosed collatera1. Investment activity cash flows are cash flows of financial investments. Clearly,purchase transactions would result in cash outflows where as sales transactions would generate cash inflows. The financing activity cash flows result from debt and equity financing transactions. Borrowing and repaying either short-term debt or long-term debt would result in a corresponding cash inflow or outflow. Similarly,the sale. of common or preferred stock would result in a cash inflow whereas the repurchase of stock or payment of cash dividends would result in a financing outflow. Summarizing the firm’s operating,investment,and financing activity cash flows during a given period helps to account for changes in the firm’s cash position from the beginning to the end of the period chosen.

Managing cash is a very important activity for financial intermediaries.

The cash flow statement provides the basic structure of all sources and uses of cash. The primary reasons that cash management is so important are related to the following aspects of financial intermediaries:

Depository intermediaries must hold reserves to meet Federal Reserve

Regulation D reserve requirements. To manage the level of reserves optimally,very precise cash flow statements are necessary.

Financial institutions are subject to very large cash inflows and outflows which require considerable planning ahead to ensure they take place as required but do not at the same time tie up a large amount of funds unnecessarily in non-earning cash assets. [中国工商银行真题]

Cash flows from debt and equity financing transactions are said to be a kind of( ).

本题可从文中直接找到答案,即第一段中的句子:“The financing activity cash flows result from debt and equity financing transactions”.

根据《中华人民共和国中国人民银行法》的规定,我国货币政策的最终目标是( ),并以此促进经济增长。

箱子里面有红、白两种玻璃球,红球数比白球数的3倍多两个,每次从箱子里取出7个白球、15个红球。如果经过若干次以后,箱子里只剩下3个白球、53个红球,那么,箱子里原有红球比白球多多少个?

将自然数1~100分别写在完全相同的100张卡片上,然后打乱卡片,先后随机取出4张,问这4张先后取出的卡片上的数字呈增序的几率是多少?()

对于债券利率的风险结构,描述正确的有( )。

市场经济体制下,财政具有的职能有( )。

( )决定着生产关系。

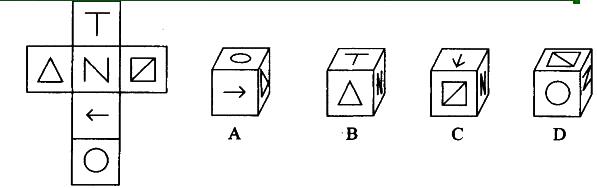

左边给定的是纸盒的外表面,下列哪一项能由它折叠而成?( )

货币制度最基本的内容是规定( )。

如果一国货币汇率上升,即对外升值,就可能会导致( )。

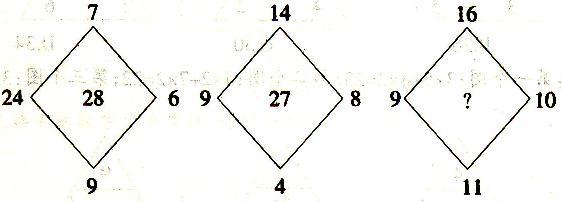

()